arkansas estate tax return

The Arkansas state sales tax rate is 65 and the average AR sales tax after local surtaxes is 926. Counties and cities can charge an additional local sales tax of up to 55 for a maximum possible combined sales tax of 12.

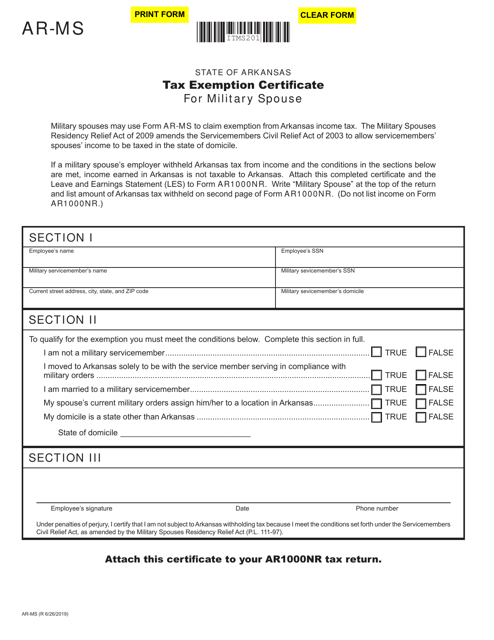

Arkansas Tax Forms And Templates Pdf Download Fill And Print For Free Templateroller

The Arkansas Division of Workforce Services Law book is located within the For Employer section of the DWS website.

. The Individual Income Tax Section is responsible for technical assistance to the tax community in the interpretation of Individual Partnership Fiduciary and Limited Liability Company tax codes and regulations. Department of the Treasury Internal Revenue Service Center Kansas City MO 64999. Estates valued under that threshold do not pay estate tax and no IRS filing is required.

Are required to file informational returns with the Internal Revenue Service and Arkansas Income Tax Division. Prescription Drugs are exempt from the Arkansas sales tax. Return to top of page.

LITTLE ROCK Ark. As a division of the Arkansas Department of Finance and Administration our mission is to efficiently promote and oversee fair equitable and uniform property tax treatment for all taxpayers local government officials and school districts within and across all seventy-five Arkansas counties. AP Arkansas lawmakers advanced tax cuts and a school safety grant program on Tuesday as they began a special session spurred by.

There is a fee to get a copy of your return. AP Arkansas lawmakers are meeting this week for a special session on tax cuts and school safety grants thats been spurred by the state sitting on a 16 billion surplus. 5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706 has been filed Department of the Treasury Internal Revenue Service Stop 824G 7940 Kentucky Drive Florence KY 41042-2915.

Other Arkansas credits include the political contribution credit of up to 50 per year. It later turned around and repealed the tax again retroactively to January 1 2013. The Ohio estate tax was repealed as of January 1 2013 under Ohio budget laws.

Were originally developed for real estate development ventures. Arkansas sales-tax holiday will begin at 1201 am. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022.

If you make 70000 a year living in the region of Arkansas USA you will be taxed 12387. Identity Theft has been a growing problem nationally and the Department is taking additional measures to ensure tax refunds are issued to the correct individuals. 1b First social security number on tax return individual taxpayer identification number or employer identification number see instructions 2a.

LITTLE ROCK Ark. The statewide rate is 65. Are created by filing a Certificate of Limited Partnership with the Secretary of State.

Minnesota has a state income tax that ranges between 535 and 985 which is administered by the Minnesota Department of RevenueTaxFormFinder provides printable PDF copies of 96 current Minnesota income tax forms. The child care credit which is equal to 20 of the federal child care credit. North Carolina also repealed its estate tax on January 1 2010 but it reinstated it a year later.

A federal estate tax is paid on the value of the taxable estate that exceeds that threshold amount. New Jersey phased out its estate tax in 2018. Tennessee repealed its estate tax in.

In 2022 the estate tax exemption is 1206 million dollars. This marginal tax rate means that. If a joint return enter the name shown first.

Every taxpayer has a lifetime estate tax exemption. Must file an annual report with the Arkansas Secretary of State. Your average tax rate is 1198 and your marginal tax rate is 22.

Arkansas has 644 special sales tax jurisdictions with local sales taxes in addition to the. Saturday and end at 1159 pm. These additional measures may result in tax refunds not being issued as quickly as in past years.

Preparing and distributing tax forms and instructions to individuals and businesses necessary to complete Individual Partnership. Form 4506 Request for Copy of Tax Return. Act 757 of 2011 requires the state to hold a.

The liability documents to establish and terminate an unemployment insurance tax account wage adjustment forms and blank reporting forms can be found within the For Employer section under UI Employer Forms. And the credit for adoption expenses also 20 of the federal credit. Arkansas has some of the highest sales taxes in the country.

Welcome to the Arkansas Assessment Coordination Divisions website. 8939 historical form only Department of the. A handful of states collect estate taxes.

Name shown on tax return. Check your refund status at.

Where S My Refund Arkansas H R Block

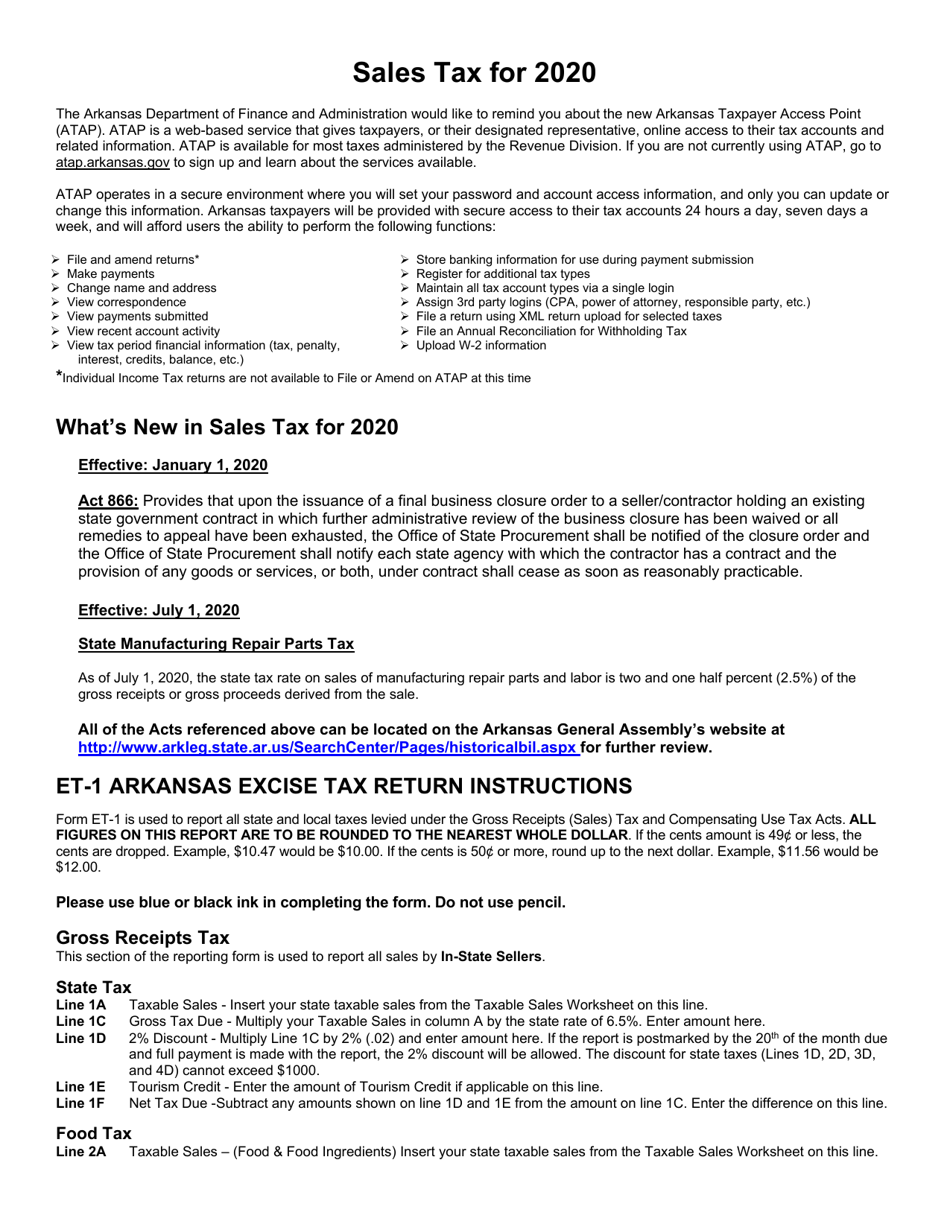

Download Instructions For Form Et 1 Arkansas Excise Tax Return Pdf 2020 Templateroller

Arkansas Quit Claim Deed Form Quites The Deed Arkansas

The Minimum Salary You Need To Be Happy In Every State Find A Job Can Money Buy Happiness Happy

Free Arkansas Name Change Forms How To Change Your Name In Ar Pdf Eforms

/cloudfront-us-east-1.images.arcpublishing.com/gray/KJSDRQJHZVAGBNULTNGHKROH6A.jpg)

Arkansas Lawmakers Advance Tax Cut School Safety Bills

The Ultimate Guide To Arkansas Real Estate Taxes

Arkansas Estate Tax Everything You Need To Know Smartasset

Arkansas Excise Tax Return Et 1 Form 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

Arkansas State Tax Refund Ar State Income Tax Brackets Taxact

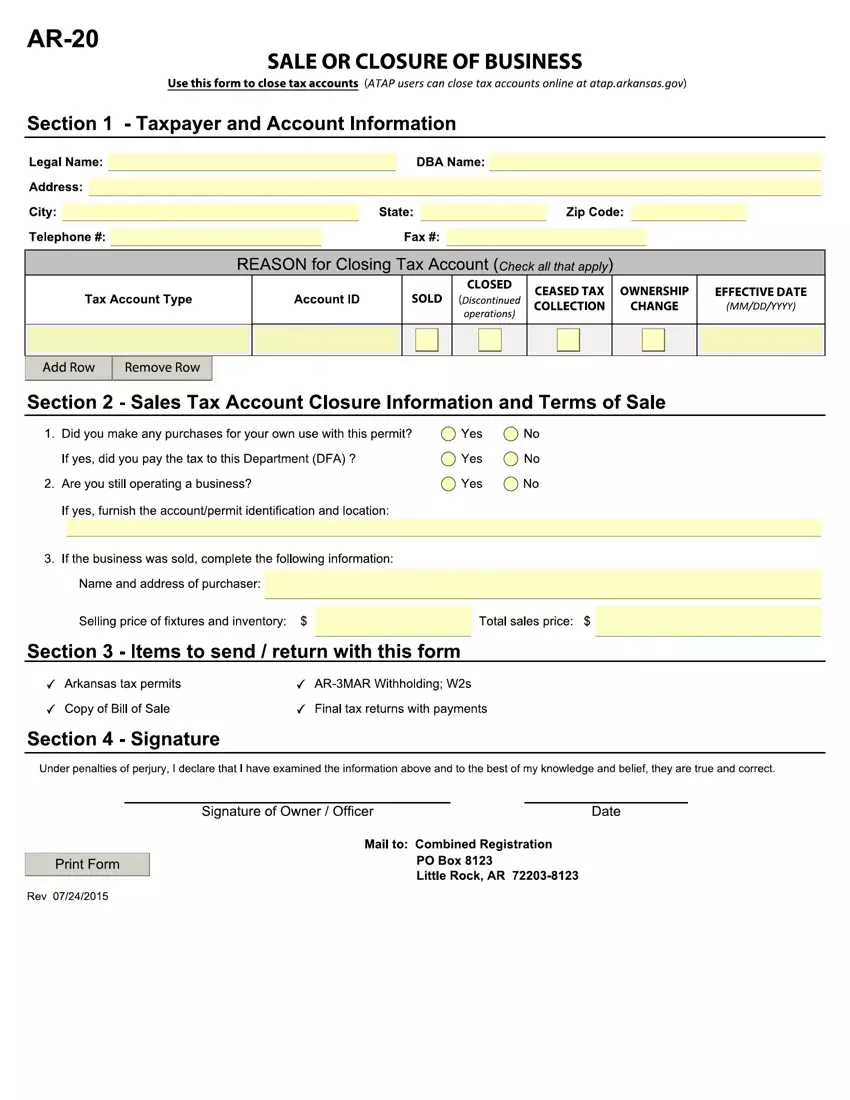

Ar 20 Form Fill Out Printable Pdf Forms Online

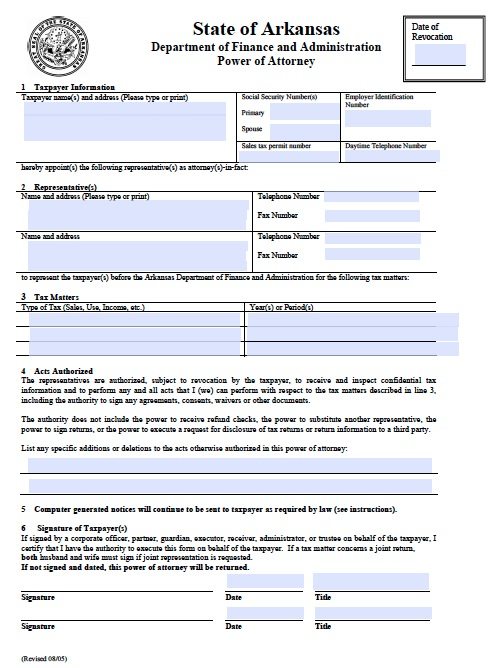

Free Tax Power Of Attorney Arkansas Form Pdf

How To File And Pay Sales Tax In Arkansas Taxvalet

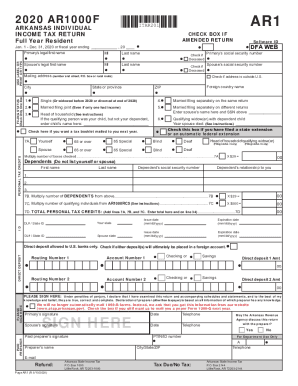

Arkansas State Income Tax Form Fill Out And Sign Printable Pdf Template Signnow

How To File And Pay Sales Tax In Arkansas Taxvalet

Arkansas State Tax Information Support

Arkansas Estate Tax Everything You Need To Know Smartasset